ETH Price Prediction: Technical Breakout and Institutional Momentum Signal Path to $5,200

#ETH

- Technical Breakout Potential: ETH trading above key moving averages with MACD showing bullish momentum suggests upward price trajectory

- Institutional Adoption Accelerating: Major investments totaling billions from institutions like BitMine and SharpLink demonstrate growing confidence

- Fundamental Strength: Record smart contract activity and $76B RWA market expansion provide solid foundation for continued growth

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Averages

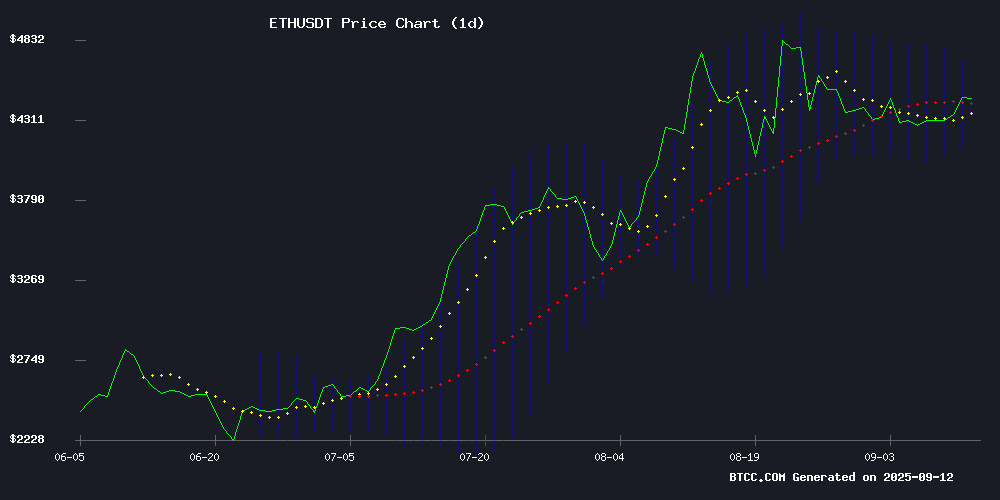

ETH is currently trading at $4,517.75, positioned above its 20-day moving average of $4,405.94, indicating sustained bullish momentum. The MACD reading of 129.34 versus its signal line at 107.51 demonstrates positive momentum with a healthy spread of 21.83. The price remains within the Bollinger Band range ($4,158.27 - $4,653.60), suggesting room for upward movement toward the upper band resistance.

According to BTCC financial analyst Sophia, 'The technical setup supports continued strength with ETH maintaining above critical support levels. The MACD divergence and position relative to moving averages suggest potential for testing the $4,650 resistance zone in the NEAR term.'

Market Sentiment: Institutional Demand and Fundamental Developments Drive Optimism

Recent developments highlight significant institutional interest with BitMine's $201 million ethereum purchase and SharpLink's $3.7 billion investment sparking renewed rally momentum. Ethereum smart contract activity reaching record highs combined with the growing Real World Assets (RWA) market surging to $76 billion demonstrates robust fundamental strength.

BTCC financial analyst Sophia notes, 'The convergence of institutional adoption, record smart contract activity, and the tokenization wave led by major players like BlackRock creates a compelling bullish narrative. These fundamental factors align with technical indicators pointing toward potential突破 of the $5,200 ceiling by October 2025.'

Factors Influencing ETH's Price

ETH to Cross $6.5K in 2025 – Analysts Highlight Altcoin Opportunities

Ethereum's price trajectory suggests a bullish breakout, with crypto analysts projecting a climb to $6,500 by year-end. Institutional demand and heavy accumulation are fueling these optimistic forecasts, though some predict even higher targets near $6,800.

Historical patterns indicate that outsized gains often emerge from undervalued altcoins rather than established giants. Ethereum's recent consolidation between $4,200 and $4,500 masks underlying strength—on-chain data reveals $7.5 billion worth of ETH moved into long-term wallets at the $4,300-$4,400 range, creating a potential support zone.

Market dynamics now hinge on a tug-of-war between new accumulators and profit-taking holders. Binance depositors, with an average entry price of $3,150, may soon test the rally's sustainability as prices hover near all-time highs.

Ethereum Completes Biggest Validator Slashing in Proof-of-Stake Era

Ethereum's Beacon Chain witnessed its largest validator slashing event since transitioning to proof-of-stake, with 39 validators penalized for conflicting attestations. The incident, occurring on September 10, resulted in estimated losses exceeding $52,000, primarily affecting nodes linked to Ankr. Validator keys running across multiple systems were identified as the root cause, leading to double entries and subsequent penalties.

Market dynamics remain uncertain as ETH struggles to breach the $4,500 resistance level. The slashing underscores persistent operational risks in proof-of-stake systems, where technical errors can translate to substantial financial consequences. Ethereum developer Preston Vanloon clarified the mechanism behind the slashing, highlighting the challenges of maintaining consensus across distributed systems.

Ethereum Price Surges to $4,513 as SharpLink's $3.7B Investment Sparks ETH Rally

Ether climbed 1.94% to $4,513 after SharpLink unveiled a $3.7 billion treasury allocation to the cryptocurrency, signaling growing institutional confidence in Ethereum as a reserve asset. The move mirrors corporate Bitcoin adoption trends from previous cycles.

Technical indicators show bullish momentum, with Ethereum's RSI at 58.03 suggesting room for upward movement. Market data reveals $34.8 million in net inflows as traders position for a potential breakout from current levels.

While historical September patterns often show bearish tendencies, analysts project a possible rally to $5,817 by month-end if institutional inflows persist. The market now watches whether this corporate endorsement can override seasonal headwinds.

Ethereum Smart Contract Activity Hits Record High Amid $5,200 Price Ceiling Watch

Ethereum's network activity has surged to unprecedented levels, with daily smart contract calls reaching 12 million as traders anticipate a potential breakout above the $5,200 resistance level. The second week of September saw ETH's price trajectory continue its April ascent from $1,400 toward the $5,000 threshold, fueled by institutional accumulation and declining exchange reserves.

On-chain metrics reveal a compelling narrative: U.S. spot ETF-driven fund holdings now contain 6.7 million ETH—nearly double April's figures—while whale addresses (10,000-100,000 ETH) accumulated 6 million ETH during the same period. This cohort's 20.6 million ETH balance represents a historic high, indicating substantial 'smart money' positioning before any potential breakout.

The staking ecosystem continues tightening supply, with 36.2 million ETH now locked—a 2.5 million increase since May. This dynamic creates a structural supply constraint that could amplify upward price movements if demand accelerates.

BitMine Buys $201M in Ethereum, Now Holds $9.3B in ETH

BitMine has aggressively expanded its Ethereum holdings, purchasing an additional $201 million worth of ETH through BitGo. This marks its second major acquisition this week, bringing its total ETH treasury to $9.3 billion. The Nevada-based firm reclassified cryptocurrencies as treasury assets in June 2025, pivoting toward capital markets and staking yields.

Ethereum's price rose 3% following the announcement, with analysts attributing the bullish momentum to BitMine's accumulation strategy. The company aims to become a dominant institutional holder of ETH, a move that has already boosted its stock price significantly.

Other Nasdaq-listed firms are following suit, signaling broader institutional adoption. BitMine recently participated in PIPE financing to support Eightco’s acquisition of ETH as a core treasury asset, further solidifying its market influence.

Ethereum Price Surges: Institutional Demand Hits Record Highs, $5,000 Next

Ethereum has reclaimed the $4,500 mark as institutional investors quietly accumulate the asset, fueling speculation of a rally toward $5,000. Fund holdings have reached a record 6.7 million ETH, while total wallet balances now stand at 20.6 million ETH—a clear signal of sustained demand beyond short-term traders.

Large funds have been consistently adding ETH throughout 2025, with retail wallets of all sizes following suit. This dual accumulation creates a robust foundation for price growth. Long-term holders now control 20.6 million ETH, another record that underscores deepening conviction across investor cohorts.

Real World Assets (RWA) Market Surges to $76B as Institutions Embrace Tokenization

The Real-World Asset (RWA) sector is experiencing renewed momentum, with tokenized assets soaring 11% in the past week. Market capitalization now approaches $76 billion, while on-chain tokenized assets have reached a record $29 billion—nearly doubling since January 2025. What began as a niche experiment has evolved into a cornerstone of crypto adoption, driven by institutional demand.

Private credit dominates tokenized assets, accounting for over 50% of the market. U.S. Treasuries represent roughly a quarter, with commodities, equities, and alternative funds comprising the remainder. On-chain migration offers institutions faster settlement, enhanced transparency, and access to new liquidity pools. Retail investors gain exposure to previously exclusive financial products. "Tokenization could democratize finance," observes BlackRock CEO Larry Fink.

Ethereum maintains its position as the backbone of tokenization infrastructure, hosting more than 75% of tokenized value. Layer-2 solutions and stablecoins further cement its dominance in this burgeoning sector.

Ethereum Reclaims $4,500 Amid Institutional Demand and Exchange Outflows

Ethereum surged past $4,500, trading at $4,518, a 2.5% increase in 24 hours. The rally reflects growing institutional interest and sustained accumulation by long-term holders. Despite the uptick, ETH remains 8.6% below its August 24 all-time high of $4,946.

Derivatives markets signal heightened activity, with open interest hitting $61.72 billion and futures volume reaching $97.32 billion. CME's record open interest underscores institutional participation. On-chain data reveals 1.7 million ETH accumulated in the $4,300–$4,400 range, driven largely by Binance outflows.

The market's resilience suggests confidence in Ethereum's long-term trajectory, even as short-term volatility persists. Trading volume dipped slightly to $36.38 billion, but the underlying demand narrative remains intact.

Ondo Finance's Token Surges Amid BlackRock-Led Tokenization Wave

Ondo Finance's native token rallied nearly 10% to $1.10 Thursday, extending weekly gains beyond 21% as institutional interest in tokenization accelerates. The DeFi protocol's Global Markets Platform has seen total value locked triple to $1.57 billion this year following partnerships with traditional finance giants like WisdomTree.

BlackRock's reported plans to bring exchange-traded funds onto blockchains adds institutional validation to Ondo's tokenized assets strategy. The protocol recently launched Ethereum-based representations of 100+ U.S. equities and ETFs, capitalizing on growing demand for real-world asset tokenization.

Market analysts attribute the price surge to converging catalysts: a bullish crypto market anticipating Fed rate cuts, BlackRock's blockchain ambitions, and Ondo's first-mover advantage in institutional-grade tokenization solutions. "The excitement around tokenized stocks reflects structural shifts in asset management," noted Fischer8 Capital's Lai Yuen.

Ethereum Targets $5,200 by October 2025 as Technical Indicators Signal Bullish Breakout

Ethereum's price action is poised for a significant upward trajectory, with technical indicators converging to support a target of $5,200 by mid-October. Trading at $4,557.70, ETH has posted a 3.14% daily gain, hovering just below critical resistance levels that could catalyze substantial upside momentum.

Analysts from Changelly have progressively revised their forecasts upward, from $4,693 on September 9th to $5,027 today—a clear signal of growing confidence in Ethereum's near-term potential. The consensus among technical analysts points to sustained bullish momentum, backed by strengthening chart patterns and fundamentals.

Key levels to watch include immediate resistance at $4,660 (Upper Bollinger Band) and support at $4,210. A breakout above resistance could unlock the path to $4,850 (+6.4%) and the $5,000-$5,200 range within 4-6 weeks.

Bitmine ETH Purchase Signals Major Ethereum Price Momentum

Institutional confidence in Ethereum surges as Bitmine Immersion and SharpLink Gaming expand their ETH holdings. Bitmine's latest acquisition of 46,255 ETH, valued at $200.43 million, brings its total Ethereum treasury to over 2.1 million ETH worth $9.27 billion. This aggressive accumulation aligns with cooling U.S. PPI inflation, fueling optimism among crypto investors.

Bitmine's stock performance mirrors its Ethereum strategy, with BMNR shares climbing 2.24% to $45.60 and boasting a 551% year-to-date gain. Analyst Tom Lee maintains Ethereum's $4,300 support level remains robust, citing growing Wall Street engagement with digital assets and AI-driven token economy evolution.

Is ETH a good investment?

Based on current technical indicators and market fundamentals, ETH presents a compelling investment opportunity. The cryptocurrency is trading above key moving averages with strong momentum indicators, while institutional adoption continues to accelerate.

| Indicator | Current Value | Signal |

|---|---|---|

| Current Price | $4,517.75 | Above 20-day MA |

| 20-day Moving Average | $4,405.94 | Support Level |

| MACD | 129.34 | Bullish Momentum |

| Bollinger Upper Band | $4,653.60 | Near-term Resistance |

| Institutional Investment | $3.7B+ Recent | Strong Demand |

BTCC financial analyst Sophia emphasizes that 'The combination of technical strength, institutional accumulation, and growing real-world asset tokenization creates a favorable risk-reward profile for ETH investors targeting the $5,000-$5,200 range.'